The Importance of

Student and Staff Insurance in School Safety

Ensuring the safety

and security of schools is paramount in today’s complex world. School safety

encompasses a wide range of measures, but one of the most critical and often

overlooked aspects is the insurance coverage for students and staff. A robust

insurance policy not only safeguards individuals but also protects the

institution from unforeseen financial liabilities.

Why is Insurance Crucial for Schools?

Schools are

environments where students and staff spend a significant portion of their day,

making it essential to have comprehensive safety measures in place. While

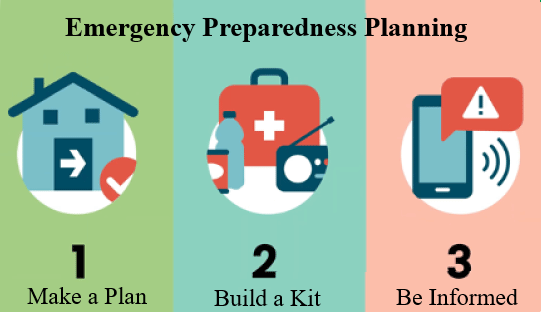

physical security measures like surveillance cameras, access control systems,

and emergency protocols are vital, insurance acts as the financial safety net

that ensures all stakeholders are protected in the event of accidents or

unforeseen incidents.

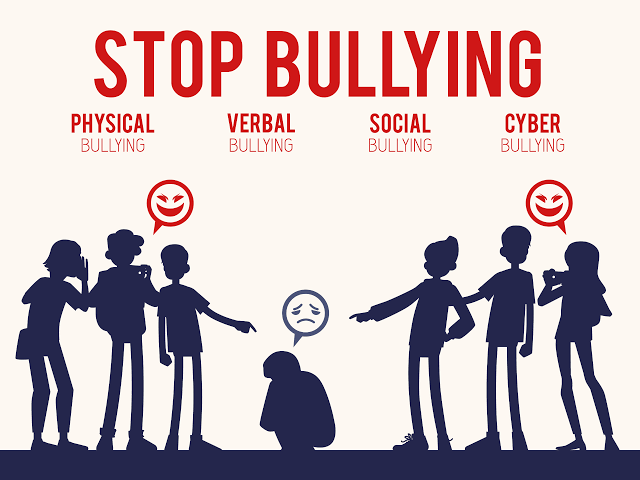

Accidents, whether

minor or severe, can occur despite the best safety protocols. For instance, a

student might get injured during a sports activity, or a staff member might

face a health emergency while on school premises. Without adequate insurance,

the financial burden of medical expenses, liability claims, or even legal

proceedings could fall on the school or the affected individuals.

Types of Insurance Policies Schools Should Consider

Schools must assess

their unique needs and risks to identify the appropriate insurance policies.

Some key types of coverage include:

- Liability Insurance: Covers legal

and financial responsibilities in case of injuries or damages caused by

negligence.

- Student Accident and Health

Insurance: Provides coverage for medical expenses incurred by students due to

accidents on school grounds.

- Workers' Compensation Insurance: Protects staff

members by covering medical expenses and lost wages resulting from

work-related injuries.

- Property Insurance: Safeguards

school buildings, equipment, and other assets against theft, fire, or

natural disasters.

Beyond Financial Protection

Insurance goes

beyond monetary compensation. It ensures peace of mind for parents, students,

and staff, fostering a positive and secure learning environment. Knowing that

medical expenses or liabilities are covered in the event of an accident allows

everyone to focus on their roles without undue stress.

Moreover, certain

insurance policies can fund physical security enhancements. For example,

liability insurance can help schools invest in better surveillance systems,

secure entry points, and emergency response tools, further strengthening the

overall safety infrastructure.

Case in Point

Consider a situation

where a school without adequate insurance faces a lawsuit due to an injury

sustained by a student during a field trip. The legal fees and medical expenses

could financially cripple the institution, disrupting its operations. On the other

hand, a well-insured school can address such issues promptly, ensuring minimal

disruption to learning activities.